Identifying House Guarantee

Prior to diving for the specifics of a versatility Mortgage house collateral mortgage, let’s know what family equity is. Household collateral represents brand new part of your property that you it is individual, computed by the subtracting the an excellent financial equilibrium from your own residence’s newest market value. Generally, this is the well worth you may have built up of your property more date.

step 1. Lower Rates of interest

Compared to the other mortgage choices, Independence Home loan now offers competitive interest rates on the household equity finance. This can potentially save you several thousand dollars inside the attract money across the longevity of the borrowed funds. Because of the leveraging the fresh new security of your home, you have access to funds at the a very positive price compared to the option borrowing steps.

2. Versatile Cost Words and you may Solutions

Versatility Mortgage understands that all homeowner’s financial predicament is exclusive. That is why they give you flexible payment terms and conditions and choices to match your circumstances. If or not you would like a fixed-price loan which have a predictable payment or a flexible line out of credit that enables that obtain as required, Freedom Financial also provides a range of choices to complement your requirements.

step 3. Tax Benefits

You to definitely great benefit off a liberty Home loan domestic collateral financing are the possibility taxation professionals. Occasionally, the eye paid to the a house guarantee mortgage is tax-allowable, allowing you to further reduce your complete income tax liability. not, it is usually advisable to talk to a tax elite group knowing the particular income tax ramifications centered on your personal points.

4. Debt consolidation

For those who have obtained highest-appeal expense, like mastercard balance otherwise signature loans, a freedom Financial house collateral financing also provide an answer getting debt consolidation https://paydayloanalabama.com/orange-beach/. By consolidating the money you owe on the a single loan with a reduced rate of interest, you might express your financial obligations and you may possibly save money inside the long term.

Applying for a freedom Home loan Household Security Mortgage

Since you are conscious of the benefits, let’s walk through the entire process of applying for an independence Mortgage household collateral financing:

Step-by-Step Guide

Research and you can gather information: Start by contrasting Independence Mortgage and you will understanding its particular requirements and you will products. Collect all vital information and files so you can improve the application form procedure.

Contact Independence Financial: Reach out to a real estate agent of Independence Mortgage to discuss their qualification and mortgage alternatives. They will certainly make suggestions from the software process and supply custom recommendations.

Finish the software: Complete the application form precisely, delivering every called for recommendations. Double-look for any problems otherwise omissions prior to submission.

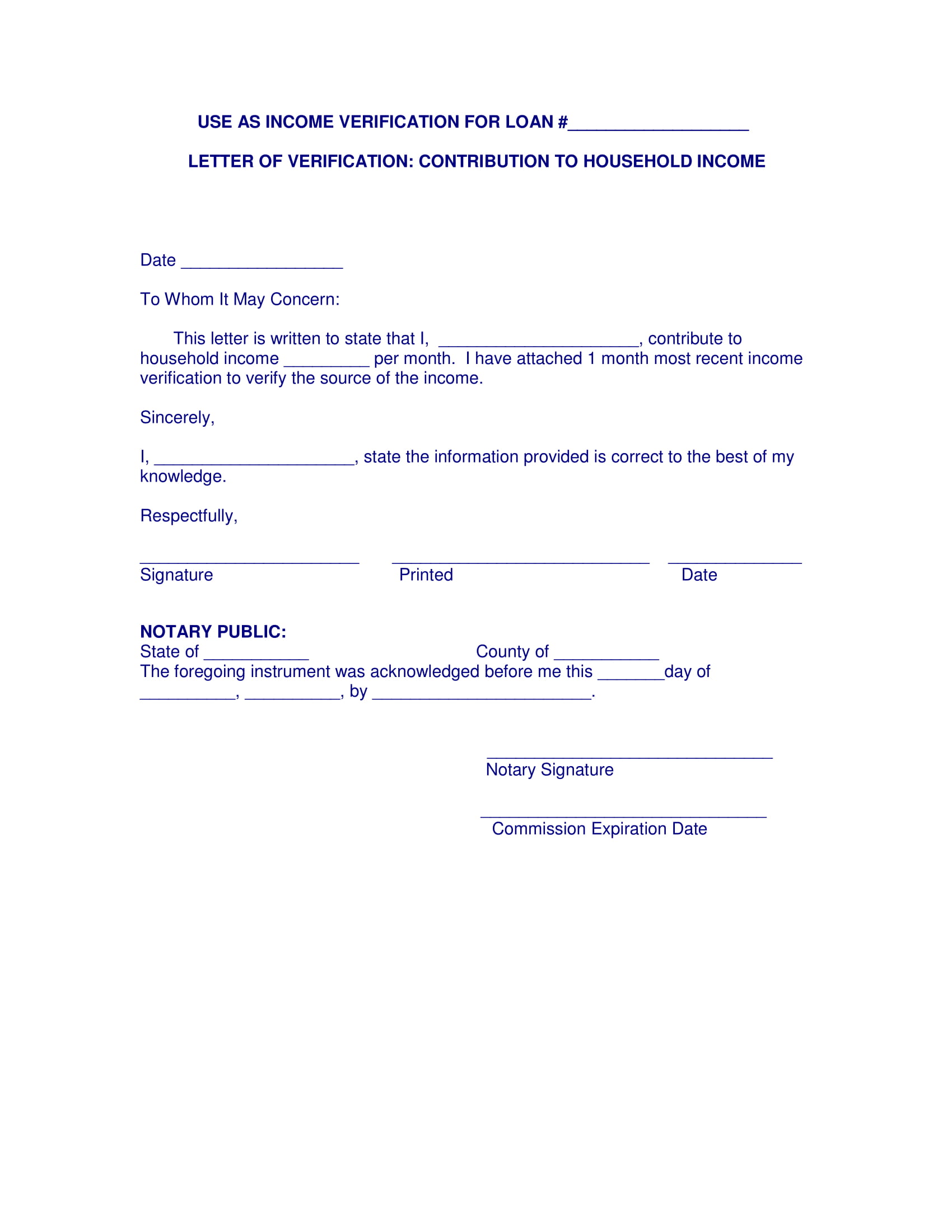

Complete files: In addition to the app, fill out the necessary paperwork, such as for instance income statements, proof of control, and you will identification files. Make sure that every documents is actually legible or over-to-time.

Wait for acceptance: After you’ve filed your application and you can records, enable it to be Liberty Financial a bit to review and procedure your own consult. They inform you towards position of one’s app and you will any additional standards, if necessary.

Techniques for a successful Software

- Take care of good credit: A high credit rating increases your chances of financing acceptance and you can could even result in more beneficial conditions.

- Prepare yourself accurate monetary statements: Make sure that your income statements and other monetary data try precise or over-to-big date.

- Plan out the documentation: Continue most of the necessary documents in order to prevent delays during the application process.

- Look for professional advice if needed: For those who have people doubts otherwise inquiries, believe consulting an economic advisor otherwise home loan expert to possess suggestions.

End

A versatility Home loan house equity financing empowers homeowners to help you open the new prospective of their property and achieve their economic desires. By the leveraging the significance you may have gathered of your home, you have access to finance at the aggressive interest levels, appreciate flexible payment possibilities, and potentially benefit from taxation experts. If or not you would like financing for renovations, degree, otherwise debt consolidating, Liberty Home loan are committed to helping you every step of one’s method. So why waiting? Mention the possibilities of an independence Home loan home collateral financing now or take command over debt coming.

Contemplate, it is very important conduct keyword development and you may improve the content consequently of the incorporating the main keywords liberty home loan family collateral loan and relevant conditions regarding blog post.