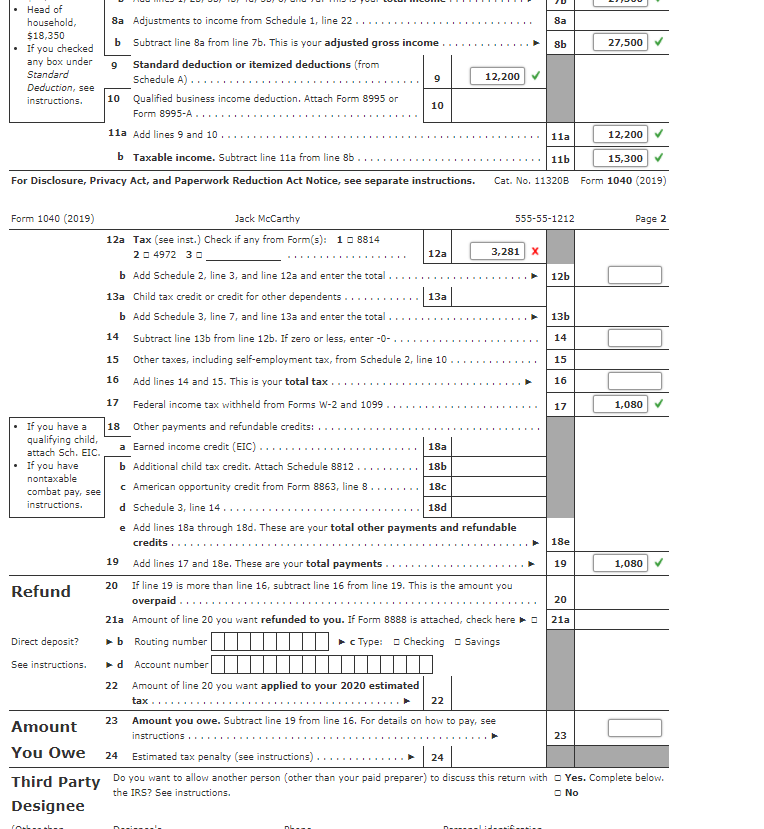

Tax statements

Proof taxation statements is additionally called for, constantly on earlier 2 yrs. The lenders request these types of documents to guage and you may guarantees you that you have a steady income, particularly if you act as a different company.

Paystubs one other way away from guaranteeing your earnings and you will bringing greater context in order to the application. Very, while new W2 is generally having taxation aim and you may paystubs document your overall spend, also extremely important whenever protecting financing.

House comments even when your loan may not be investment-dependent, indicating the access and your control of those will get greatly increase your odds of securing an excellent W2 financial. And by property,‘ i relate to everything from lender or financing accounts so you can possessions, machinery, or precious jewelry.

So you can be eligible for home financing, aside from offering the financial towards relevant files, here’s a few away from information to assist you rating accepted. Watch your credit rating you ought to monitor your credit rating because loan providers watch a good credit history, since it ensures all of them of the capacity to purchase the fresh new financial, if they leave you.

Tips Maximize your Credit scores For 1099 and you will W2-Income-Merely Mortgages

Therefore, be sure to spend the debts punctually and that one debt money are available punctually to increase your credit rating. Opinion the last a couple taxation statements these types of payday loans Henagar, AL online data help loan providers influence your own average earnings. If at all possible, it can let if you had returned for the past a couple years. And additionally, with the help of our efficiency, you could potentially manage your expectations regarding the number of mortgage your can afford.

Exactly how Financial obligation-To-Money Proportion Has an effect on Capability to Pay-off Financial

Maintain a minimal personal debt-to-earnings ratio a reduced personal debt-to-earnings ratio is among the many standards from mortgage lenders to possess recognition. Very, should your DTI ratio was large, just be sure to eradicate they before applying the out of this type of mortgage loans to increase your chances to have approval. Stop your nonexempt deductions although this might seem unattainable, cutting nonexempt deductions is very much you’ll be able to and certainly will go good long way within the boosting your probability of providing accepted.

Mortgages To have Separate Specialist Wage Earners

Many separate builders generally have of numerous taxable write-offs, reducing the nonexempt money and you will reducing your odds of qualifying to possess a home loan. Simultaneously, a lot fewer taxable deductions enhance your taxable income, which in turn convinces a loan provider of your qualifications for the home loan.

Enhance your compensating things in terms of 1099 otherwise W2 money mortgages, lenders want much extra research to help you invest in leave you home financing.

Due to this fact having large compensating activities increases the possibility of getting recognized. Situations particularly that have good-sized savings or a huge deposit usually considerably increase possibility, even with a below-average software.

Bringing Approved For no-Tax Return Mortgages

In conclusion, 1099 and you may W2 income-simply mortgages bring a nice-looking selection for self-employed people otherwise discover income regarding several provide trying pick a house. These types of financial support people that might not have the brand new old-fashioned revenue stream be eligible for that loan while having toward household of their hopes and dreams. Although not, 1099 and you may W2-income-just mortgages also require papers and you may documents.

All of the mortgage lenders need to ensure the brand new debtor is also repay their new real estate loan. Records and papers see whether financial underwriters determine whether new debtor find the money for spend the money for mortgage loan.

You may need a down payment in order to secure an effective W2 income home loan, while have to show it which have files on lender. You are simply exempted when you are obtaining Va or USDA money. Fundamentally, whenever we chat regarding down payment proof, i make reference to data that confirm the availability of investment so you can contain the get. The level of the latest down-payment may differ with the loan providers.