Quality Home loans, Inc., also called just Quality was a nationwide bank that has been doing team because the 2008. They are headquartered within the Coppell, Colorado and the team now offers numerous financial loans and a column from non-qualified financial products to own consumers that do not fall under antique financing direction. In the 2022, Quality is actually received of the NewRez. Today, anybody who can be applied to own an alternative financing which have Quality need to price which have NewRez while people that already got a quality loan prior to 2022 continues to manage Caliber.

It is important to learn whether your mortgage has been addressed from the Caliber or NewRez. While the a service, discover various other defenses you may have to have fun with against NewRez. not, if the financing has been that have Quality, there are many protections available. Less than, all of our Quality Lenders, Inc. foreclosure security attorneys explains far more.

Grievances Up against Quality Mortgage brokers, Inc.

Quality keeps an a+ credit rating towards Better business bureau site. However, it doesn’t mean which they usually remove customers rather. The company has experienced 442 grievances closed in the last three ages, and 85 ones was closed-in the past one year.

Some of these complaints state that Caliber delivered homeowners emails saying you to a repayment wasn’t designed to the escrow membership. New statements these home owners had indicated that they’d produced escrow payments. Not just are it a stress having residents, however they had been next as well as billed a penalty fee towards organizations mistake.

In other grievances, Quality is implicated off subtracting payments off borrowers‘ levels that they not individual. That it will occurred after home financing are transported away from Caliber to NewRez. The newest individuals generally speaking don’t come to Caliber in such cases, and you will NewRez states that it’s a problem with Caliber and you may maybe not all of them.

Of numerous property owners and additionally obtained letters regarding Quality proclaiming that they were outstanding for the real estate loan money. Just after talking to agents of the providers, it absolutely was concluded that this was a blunder one to impacted many individuals. Regrettably, it grievance in addition to the individuals in the above list isnt strange when it comes to Quality and you can NewRez. In the event that possibly business has managed you unfairly, you ought to keep in touch with a caliber Home loans, Inc. property foreclosure protection attorneys that will supply the legal services you would like.

Litigation Submitted Up against NewRez

After hearing the countless problems generated facing Caliber, some individuals are treated to learn one to their home mortgage could have been moved to NewRez. Regrettably, NewRez could have been the subject of of a lot lawsuits to possess neglecting to cure customers very. Some of the most common accusations produced in such legal actions are listed below:

- NewRez engaged in predatory credit means by appraising features in the an effective higher worthy of than others property were really worth.

- NewRez got benefit of people who have been incapable of see the financial information on its circumstances.

- NewRez sent homeowners misleading statements saying that these were inside the default to their home loan repayments. This type of consumers had exercised an excellent forbearance package according to the Coronavirus Aid, Save, and you can Monetary Defense (CARES) Act.

Since the significantly more than violations was in fact detailed in several private legal actions and group action litigation, such allegations were made against NewRez. Nevertheless, Caliber Mortgage brokers, Inc. might have been implicated of numerous of the same form of procedures. Luckily for us, if NewRez otherwise Quality Home loans was taking legal action against you, there could be defenses available.

- Loan modification: You could apply for financing amendment privately owing to Quality or NewRez. Once you implement, these businesses have to review your application from inside the good-faith. If you find yourself your application try around review or after a buddies has actually acknowledged it, he could be banned regarding shifting which have a foreclosures up against your.

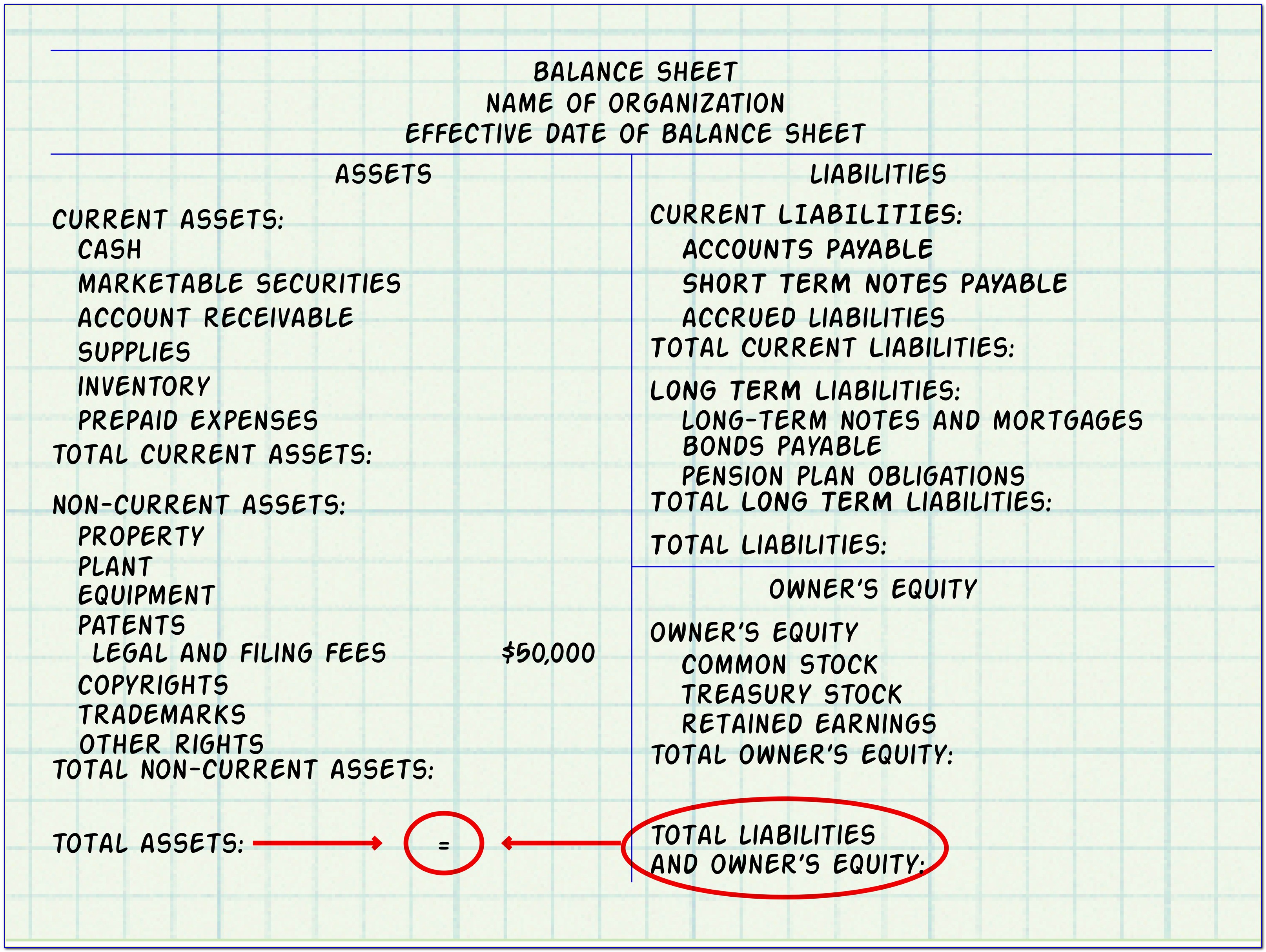

- Deficiencies in updates: Both Quality and you may NewRez have purchased packages off home loan repayments away from other loan providers. Within these transactions, very important documents transform hand several times. In the event the either providers usually do not generate your own home loan notice, they can not confirm that they very own our home financing. Within these factors, you could potentially believe the lender otherwise servicer does not have position. Fundamentally, it means he has you don’t need to document case because they don’t stand to victory or remove from it. Just like the lender otherwise servicer will get proper this case, it may give https://paydayloansconnecticut.com/riverton/ you plenty of time to bring your mortgage current.

- Deed-in-lieu of foreclosure: This new shelter regarding a deed-in-lieu away from foreclosure requires one to supply the bank or servicer the latest action to your home in return for stopping a foreclosures step. Which coverage will not create a resident to keep their possessions, nonetheless it are able to keep a foreclosures action off their credit number.

- Bankruptcy: Processing sometimes Chapter 7 otherwise Chapter thirteen bankruptcy makes it possible to save your domestic. Fighting foreclosure playing with Part thirteen is usually the more sensible choice. A section seven bankruptcy enables you to protect 100 per cent away from the newest guarantee in your home. While in the a section thirteen bankruptcy, you can spread your outstanding money across a period of around three to 5 years, giving you longer to catch on payments. In just about any case of bankruptcy instance, a courtroom will matter an automatic stand. This prohibits lenders and you may servicers from continuing having foreclosures actions and you may conversion process.

This is not a simple task to choose hence safeguards is the greatest on the property foreclosure circumstances. A quality Lenders, Inc. foreclosure safety attorneys helps you figure out which method is better to use in your case.

Call The Quality Mortgage brokers, Inc. Foreclosures Shelter Attorney when you look at the Fort Lauderdale Today

While you are within the concern about shedding your house, you need legal services. Within Financing Solicitors, our Fort Lauderdale foreclosure protection attorney can be opinion the details away from their case and create an effective case that can make you an educated chance of keepin constantly your domestic. Name the Florida property foreclosure cover lawyer today during the (954) 523-4357 or contact us on the web to help you request a free of charge visit and to learn more

- About the Author

- Latest Listings

Mortgage Solicitors consists of experienced user liberties attorneys exactly who play with every offered resource growing total financial obligation solution actions. Our goal would be to deal with people burdens, resolve those individuals trouble, and enable our very own website subscribers to bed peacefully understanding he could be towards the the path so you can a far greater coming.