Perhaps you have viewed a familiar guy unable to build one another their comes to an end meet despite working day and you may nights? Once you keep in touch with all of them, you realise they truly are crazy or sick of modifying ranging from their spots and satisfying a household need.

You will find heard about some body wishing for getting money in the start of month rather than the history day or perhaps in the 1st week of next month. They feel it more income at your fingertips you are going to resolve the issues. Needless to say, I cannot change the trend of the employers as they has her factors and you can reason.

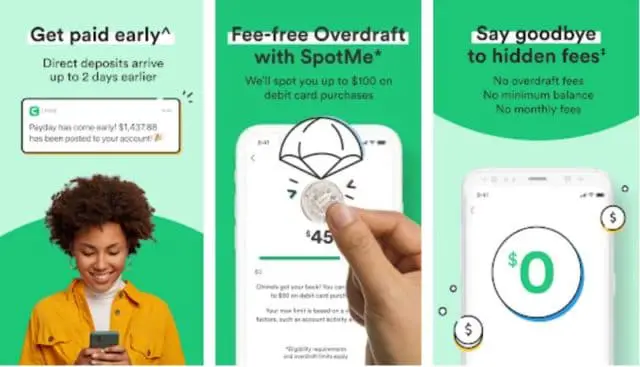

That it enterprise is a simple financing provider that enables profiles so you can get fund easily without gonna banks. In addition, it reveals the newest possibilities to possess profiles to find funds up to Rs 20,000 for free and pay later on – providing them continue their life instantaneously.

Profiles struggle with multiple efficiency circumstances

User views revealed that it purchased items always inside the dollars and you can the thought of using credit cards was problematic for all of them as they need to pay some regular prices to even have fun with the service. There can be along with the opportunity to miss out the deadlines on their very own while this software can also be publish them a reminder.

- Loans

- Family

- Family

A beneficial 2019 Borrowing from the bank Conduct statement from Bristol School offered immense notion to your exactly how money category varies affiliate habits toward finance.

Loan Application into the lower-income category – Framework Case study

- Residents keeps high amounts of credit than simply non-residents

- Credit limit expands towards playing cards and make pages be he is in charge but best them toward a passing-trap of funds and repayment

- Low-income property try less likely to have fun with credit than those into highest revenues. When they carry out borrow, it was and then make ends meet and you will pay money for basics; and are also prone to have fun with highest-rates loan providers.

I took this type of three facts given that presumptions while deciding the circulate because they’re mainly expected to work with a massive listeners because they’re dependent the research.

To stay from heading deep towards the motivation and you will strengthening a simple solution regarding build was not extremely effective as somewhere, users‘ activities and you may pressures are nevertheless untouched in that.

Mortgage Software to your lowest-money category – Construction Case study

- It functions as a checklist while making myself stick towards the a beneficial reliable street with enough versatility to understand more about the newest proportions

- They assurances users demands is came across while inserting towards globe contours

But why must I want to mortgage from a friends, in place of browsing a lender once the money is still a beneficial really close topic and folks don’t want to strange out by getting fund out-of a lender for a few days given that bringing financing means enough techniques and you will takes time?

One other alternative would be to mortgage away from family or a friend but do not because they’re constantly exposed ended versus extremely obvious talks making things difficult once you deal with them the very next time. As well as, it may ruin your relationships because it produces pressure as soon as you see them while feel like you owe them much over currency.

Since the dad used to state: There are two sure a means to dump a pal, a person is to help you acquire, one other so you’re able to provide. ? Patrick Rothfuss, The name regarding Piece of cake

Through this project, we desired to understand more about exactly how we will get money quickly without fretting about way more anything than repaying and you will carrying on their lifetime more effectively. Especially centering on the second billion pages because they has a great large amount of dilemmas on account of money, which is repaired without having to be disrespected. They work very difficult to look after and you will improve their existence. The target is to execute human beings first method as the delivering an effective loan or talking about your financial standing has been taboo.

I desired to understand a little more about the problem so because of this, the idea was to discuss new profile from additional views to help you clean out all of the biases and also to work through loans Reeltown the knowledge.