Your local Guidance Enterprise away from The usa, otherwise NACA, assists reasonable-and-modest money homeowners safe financial support to find and you will redesign homes. Created in 1988, NACA set a goal to construct good neighborhoods using affordable homeownership.

How much does NACA Perform?

NACA prepares upcoming property owners which have financial studies and you may help. The company also offers financial guidance to be sure a buyer are capable of the latest union necessary to purchase a home and you can shell out to possess ongoing upcoming costs associated with homeownership. NACA participants also have usage of loan providers giving the lowest-speed, no-fee real estate loan.

Homeowners who would perhaps not be eligible for a traditional mortgage may turn to NACA to have assistance. Instead, the fresh nonprofit business put up its very own technical and you can underwriting assistance paying attention to the reputation-oriented financing. If the individuals become NACA-licensed, they can make an application for home financing from organizations homebuying system.

Just how NACA Support Homebuyers

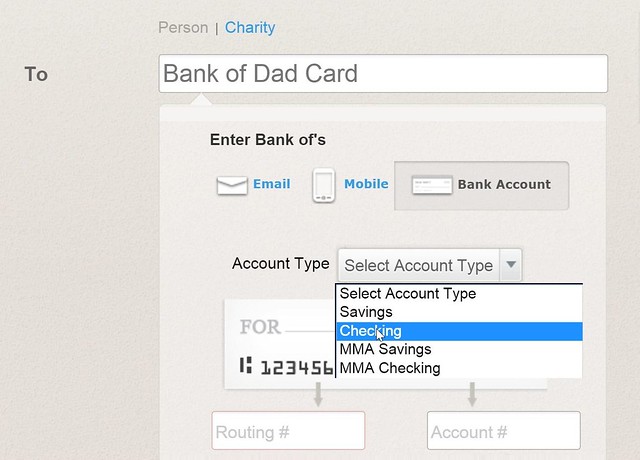

NACA provides more 40 organizations in the nation, with lots of situated in high towns and cities for example New york city, Boston, Chicago, and you will Washington, DC. NACA does not originate mortgage loans however, works with additional loan providers, like Financial regarding America, to incorporate what the nonprofit describes as Better Mortgage in the usa. Ranging from 1996 and you may 2021, Lender from The usa and you can NACA’s union lead to more than 42,000 mortgages.

NACA believes about power away from homeownership and you may aims to simply help low-and-reasonable income consumers just who might not typically be eligible for a mortgage. Each year, NACA holds neighborhood situations all over the country inside Queens, New york, Baltimore, MD, and you may Miami, Fl. Such incidents draw tens and thousands of attendees wanting to find out about so it book family-to find possibility.

New organization’s method starts by the teaching potential homebuyers courtesy five-time classes. Brand new program’s financing acceptance viewpoints takes into account a keen applicant’s a job stability and you can capacity to make ends meet thought under their handle.

Likewise, NACA assists with almost every other regions of homeownership, and house home improvements, as a result of their house and Neighborhood Service (HAND). Just after settlement, the brand new Subscription Advice Program (MAP) supports the new home owners and assists those who work in economic stress end property foreclosure.

What does NACA Require Of Homebuyers?

When you are selecting a good NACA home loan, you can study more and more the business of the going to a city enjoy and you may talking to their employees and you may volunteers. To sign up the new NACA processes, you ought to decide to do the following:

Sit in a Homebuyer Working area

The process begins with a free of charge Homebuyer Workshop. You don’t need to join NACA to go to which initially experiences. At working area, you will see about NACA’s certification process and you can pay attention to testimony out of other people that used NACA to greatly help buy their residence.

Are now living in your house you purchase

NACA provides the means to access investment getting consumers in search of to acquire a beneficial home that will assist as their number one household. NACA will set a $25,000 lien toward assets in order that the home remains owner-occupied whenever ordered playing with a beneficial NACA mortgage Florida personal loans. You simply can’t make use of the NACA system to purchase a residential property, apart from multi-family functions in which owners live-in one of several gadgets. Once you pick property thanks to NACA, you simply can’t individual all other home. The fresh NACA system allows timeshares.

Actually be involved in the company

NACA needs their users personally sign up for the business as a result of advocacy otherwise volunteering at a minimum of 5 events from year to year. NACA as well as charges a nominal registration commission away from $twenty-five.

NACA Mortgage Terms and conditions

People exactly who feel NACA-qualified can apply having a mortgage from the nonprofit’s credit lovers and discovered a decreased-price, no-percentage financing. Whilst the NACA program prioritizes reasonable- and you may modest-earnings some body, higher-income buyers wishing to get belongings during the neighborhoods identified as top priority section can also take part. However, non-consideration people will get discovered less beneficial interest rates.