To be obvious, property equity loan (HEL) is a kind of next mortgage. As a couple sound equivalent, discover subtle differences which make all these solutions novel. When you’re an effective HELOC work a lot like a card extension, allowing consumers to monthly installment loans Hammond IL make use of as often otherwise only a small amount of the own collateral, family collateral money bring a single lump sum payment of money initial.

That have a property equity financing, the lending company can give individuals which have a loan predicated on a part of security in a respective house. Barely usually lenders allow it to be homeowners so you can borrow on all the security within their property. Ergo, investors with $100,one hundred thousand in collateral inside their local rental assets could possibly use a portion of your own money he’s into the security, up to no matter what financial deems appropriate for her state. Given that domestic security funds was, in fact, a-one-go out lump sum payment, their attention pricing is actually fixed.

[ Thinking ideas on how to funds your first investment offer? Click on this link to join up for our Online home category where you are able to understand how to get started within the a residential property purchasing, even after limited financing. ]

Taking out fully another mortgage into the money spent property enjoys supported people just like the a beneficial alternative supply of investment. If the, to possess very little else, the greater indicates a trader knows how to secure financing, a lot more likely he could be so you can safer an impending offer. However, it must be indexed you to an additional home loan for the leasing possessions assets actually in the place of several tall caveats. Such as for instance virtually every means used in the true house expenses landscaping, you must weighing the benefits and you can cons out-of 2nd mortgage loans. Only when an investor is for certain the fresh new gurus outweigh the brand new negatives when they contemplate using a moment financial on money spent property. Here are a few of the most prominent positives and negatives from taking right out next mortgage loans into the local rental characteristics so you can means your opinion.

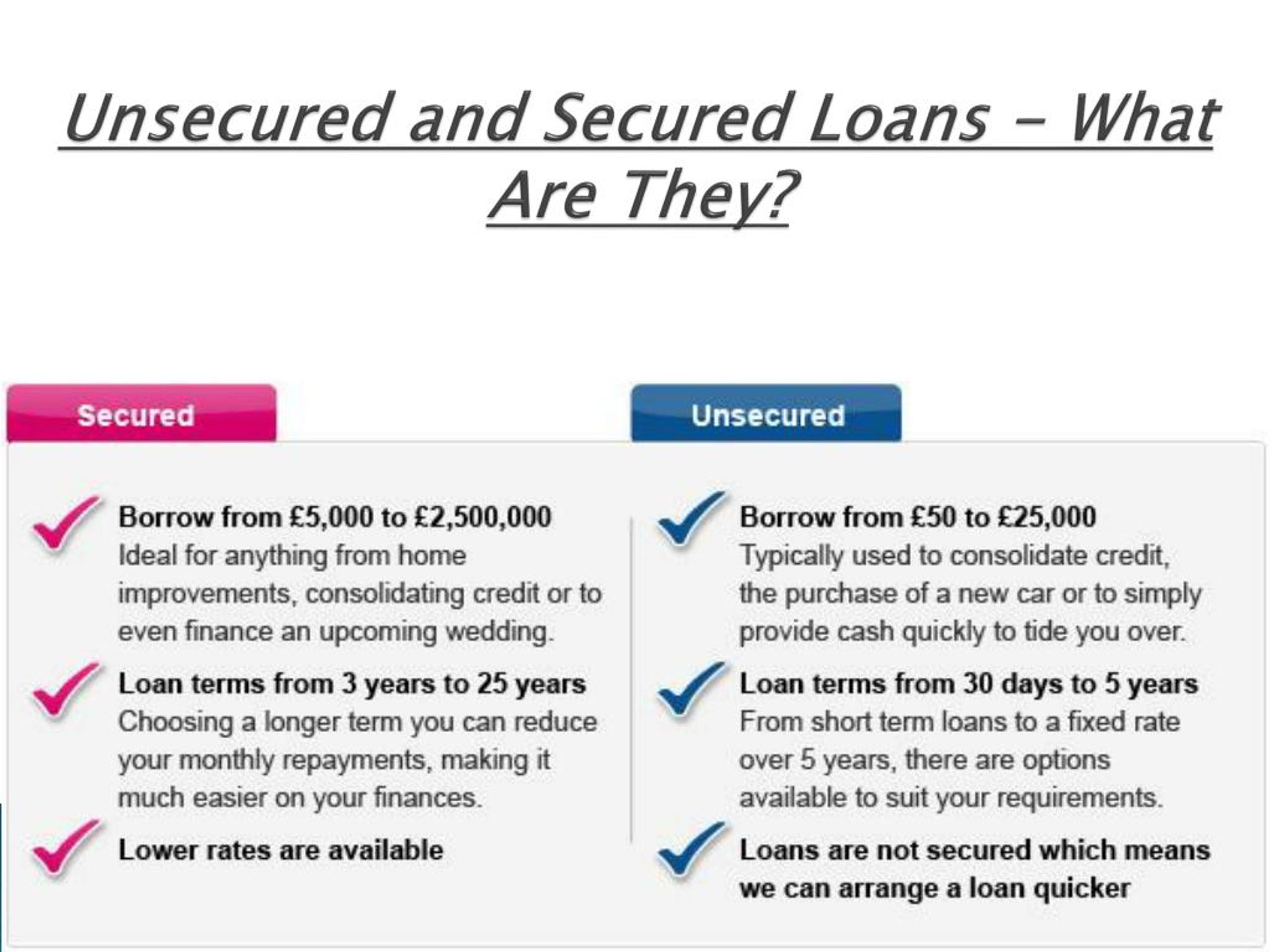

Actually, there are 2 first version of next mortgage loans: home guarantee funds and you may home security personal lines of credit (HELOC)

An extra financial allows people to make use of if you don’t stagnant, non-performing home collateral and put their money to function to them.

Next mortgages allow it to be home owners to find subsequent financing attributes. Also referred to as a second home loan investment property, a financial investment purchased which have one minute financial is capable of returning far more earnings than empty guarantee.

2nd mortgages is secure by asset he could be removed facing. Thus, people skipped money or inability to get to know mortgage personal debt you may influence about loss of the original advantage (our home familiar with use collateral up against).

Used badly and you can as opposed to a want to build a profit, second mortgages are a different way to change equity towards the personal debt.

Turning The second Home loan With the Cash

2nd mortgages can serve as a way to obtain resource. The latest collateral you have in their own house is good supply to make use of, but We digress. Using the equity on your no. 1 residence isn’t risk-free. Whenever i currently alluded so you can, one minute home loan use the first house (your own house) once the equity. If the borrower of the second financial cannot sit most recent into their costs, the lender may go just after their house. Next mortgage loans should be taken very positively; do not simply take one aside into trivial acquisition of material property. The fresh new effects you to definitely correspond which have later or skipped costs are way too big so you can chance such as for example a minor get. That said, 2nd mortgages is also portray a beneficial chance for people trying make a profit. When you’re sure you’ll leverage the next home loan into an enthusiastic opportunity to benefit, it could be practical.