When residents are thinking about to acquire a separate household, one solution they might speak about is utilizing a home security loan. A home security mortgage comes to credit contrary to the value of their most recent possessions. Let us dig greater with the understanding home collateral loans and if they can be used to purchase another type of home.

Expertise House Security Loans

A home security mortgage, known as another mortgage, loans Penrose lets property owners to help you borrow secured on the fresh security he has manufactured in their number 1 quarters. Collateral is the difference in the current market price of one’s household as well as the a good mortgage balance.

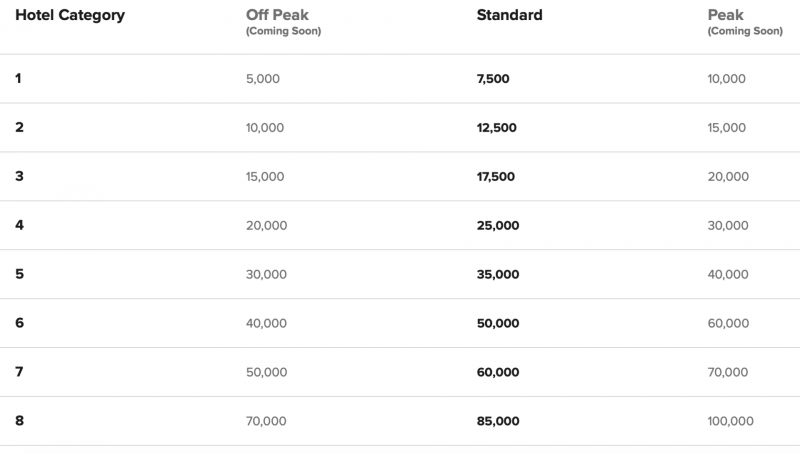

Domestic equity money typically give repaired rates of interest and you can cost terms, and then make cost management smoother versus a home Collateral Line of credit (HELOC). The quantity and this can be accessed by way of property security loan often is limited to a certain part of the new house’s worth, typically up to 85%, with respect to the homeowner’s guarantee fee plus the lender’s conditions.

The answer was yes, it is possible to play with property equity loan to invest in a different home. The process fundamentally pertains to obtaining property guarantee financing and utilizing the newest continues as the a down-payment and also for closing costs to the brand new domestic . By leveraging brand new guarantee within their newest assets, property owners decrease otherwise clean out out-of-pouch costs when buying another household.

However, there are particular factors to consider just before playing with a property guarantee financing for this purpose. Lenders usually need people to possess reasonable equity within first household and you can a good credit rating in order to be eligible for an additional financial. They usually impose that loan-to-well worth (LTV) proportion of 80% otherwise faster and you can a debt-to-earnings (DTI) ratio of 43% or down. These types of standards make certain that residents have sufficient security and you can monetary balances to cope with several financial debt.

It is important for homeowners to closely assess its finances ahead of choosing to have fun with a house guarantee mortgage to invest in another domestic. Talking to economic advisors and you can understanding the tax effects and you can complete monetary effect is crucial for making the best decision. Because of the contrasting their guarantee, loan-to-worth ratio, and as a result of the related rates and you may charges, home owners is know if playing with a property equity loan ‚s the right selection for their specific circumstances.

You should make sure

Before carefully deciding to utilize a property guarantee mortgage to order a special family, there are lots of tactics to take on. Knowledge such affairs will assist you to generate an educated decision regarding the if a property equity financing is the best option for their disease.

Comparing The Collateral

One of many important points to assess is the level of guarantee you may have on the current household. Security stands for the difference between the residence’s market value in addition to a fantastic harmony in your financial. The greater guarantee you have, the more the possibility borrowing from the bank electricity having property collateral loan.

Loan providers usually enable it to be home owners to view around 85% of its home’s well worth owing to a property guarantee mortgage, though this may will vary based on the lender’s requirements and also the homeowner’s guarantee fee. Carrying out an extensive evaluation of one’s equity gives you quality on how far you could potentially obtain.

Loan-to-Worthy of Ratio

The mortgage-to-worth (LTV) ratio is yet another vital cause of deciding their eligibility having a beneficial home security mortgage. LTV proportion is determined by splitting the mortgage count from the appraised value of your home. Loan providers routinely have restriction LTV percentages he could be ready to undertake, which can impact the number you could potentially borrow.

Such as for instance, in case the residence is appraised during the $300,000 and your a good home loan harmony try $200,000, your LTV proportion is 67% ($2 hundred,000 split from the $three hundred,000). Lenders could have specific LTV ratio conditions, making it vital that you learn its guidelines to determine for those who see its conditions.