Of several claims bring novel software made to assist earliest-big date home buyers, specifically those experiencing new deposit to possess a $300K home.

If you take advantage of these state-certain effort, people find valuable guidance you to definitely relieves this new monetary load off their property purchase.

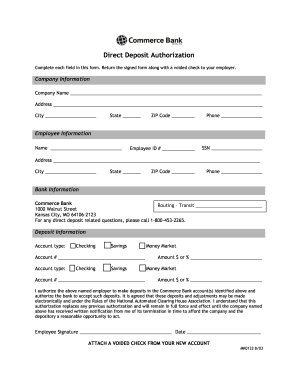

Employer-aided construction apps

Employer-Helped Homes (EAH) applications are a critical benefit to have teams, especially if you are looking at get together the money toward off percentage having an excellent $300K house.

Not only do these types of applications assist in facilitating homeownership, even so they along with serve as a tool to have employers to draw and you may keep talent. Group should query employing Hour company regarding the supply of such casing experts.

Savings

Deciding to keep to own an effective 5-20% down payment besides cuts back your month-to-month mortgage repayments and in addition makes it possible to qualify for so much more advantageous loan conditions minimizing notice cost, saving you money in the long run.

You to effective technique is to prepare a devoted family savings for the advance payment, to make typical efforts an integral part of your own monthly budget. As well, automating transmits on the family savings makes it possible to reach your goal less without the attraction to expend.

401(k) otherwise IRA withdrawals

Making use of old age discounts, particularly a good 401(k) or a keen IRA, was a distinguished option for those people searching for additional finance into the down payment having a beneficial $300K household.

The new Irs lets basic-day home buyers so you’re able to withdraw doing $10,000 regarding a keen IRA as opposed to against early detachment penalty.

Certain 401(k) plans also enable loans otherwise withdrawals to possess domestic orders. not, this tactic demands careful consideration because of prospective taxation ramifications and the fresh new effect on upcoming old age discounts North Dakota personal loans.

Yes, earnest money generally visits brand new down payment towards the property. After you create a deal toward a home, earnest money is paid as an indication of good faith to help you the seller, showing the serious interest in the house. It is kept within the an escrow account and is paid to your advance payment from the closure.

The desired credit score to purchase a beneficial $300K home typically selections from 580 so you can 720 or even more, with respect to the version of financing. Having a keen FHA financing, minimal credit rating is often up to 580. Conversely, old-fashioned fund essentially wanted the very least rating away from 620, however, protecting even more beneficial rates usually means a get more than 720.

You may need a down payment out-of $nine,000, otherwise step 3 %, if you are to shop for a great $300K house or apartment with a conventional mortgage. At the same time, a keen FHA mortgage needs a slightly highest down-payment away from $10,five-hundred, that’s step three.5 per cent of your purchase price.

The amount of domestic you can afford hinges on several out-of parameters such as your down payment, interest rate, assets taxation, insurance rates, as well as your almost every other monthly obligations such as for instance automobile and you can charge card money. Whenever a deposit out-of 20%, an interest rate off six.5% and additional month-to-month debt out-of $500/few days, you’ll need to secure around $80,000 to cover the a good $three hundred,000 home.

Your debt-to-earnings ratio, otherwise DTI, is where much money you borrowed than the simply how much your secure, expressed just like the a share. Estimate DTI from the separating their disgusting monthly earnings (pre-taxation income) by your minimum month-to-month obligations costs, including loans including car and truck loans, student loans, charge card costs, and even child support. For instance, should your month-to-month pre-taxation money is $cuatro,000, along with $step one,000 worth of monthly obligations repayments, then your DTI stands in the 25 percent.

A good principle is that you must not spend more than just twenty-eight per cent of your own terrible monthly money into the construction can cost you without more 36 per cent towards complete debts, including your mortgage and you will credit card money. Such as for example, for many who earn $cuatro,000 during the pre-income tax income and also $100 in debt cost, your homeloan payment shouldn’t meet or exceed $1,340. That it monetary principle is oftentimes known as the rule.