But not, discover exceptions, and you will get a home loan for those who have crappy borrowing and you can low income. Low income, less than perfect credit lenders get more popular much more someone face financial difficulties.

No-one understands tomorrow, although after the are a couple of things can expect out of lowest-money lousy borrowing mortgage brokers:

Definition of Lower income and you will Less than perfect credit

In the future, we provide the definition of lowest-income and poor credit standards to possess lenders to change. They may maybe not transform much and can seriously be different than just what they are today.

Now, bad credit means that you’ve got a FICO rating from less than simply 620 , a financial obligation so you’re able to earnings proportion in excess of 43%, a downpayment regarding lower than 5%, and an extreme credit experiences on the earlier in the day, eg, filing for bankruptcy proceeding.

Youre sensed a decreased-earnings personal whether your income is tough to prove or does not meet the requirements not as much as antique financial guidelines. Lenders usually modify the above meanings to suit a whole lot more financial borrowers later on.

A financial will know you happen to be lower-income predicated on the proof of money for those who have you to. In case you may be self-employed, such as, you may make instantaneous spend stub duplicates on the web via websites eg PDFSimpli and you can complete the individuals out since your proof income.

Much more Home loan Choice

Lenders still have to return even in the event someone earn down incomes and possess tough credit. For this reason, you ought to expect alot more alternatives for reasonable-money, bad credit home loans down the road.

Such as for example, solution mortgage lenders like Mortgage Depot can help you rating sensible home loan pricing . People who can also enjoy unique apps such as for example FHA and you will Va fund continues to increase.

Homebuyer Preparation

Just as in a number of other one thing in life, planning is the key in order to victory. Later on, you should assume alot more homebuyer thinking getting lowest-earnings, bad credit home loan consumers, especially very first-date buyers .

More home buyers would have to undertake homebuyer studies and you will financial physical fitness programs to make them regarding the most readily useful figure you can easily even with poor credit and you will reasonable revenues.

Homebuyers can understand most of the expenses associated with to shop for a house, just how to enhance their credit score, and also have an informed financial pricing it is possible to. These apps will increase, which makes it easier having reasonable-money those with loan online Rhode Island poor credit locate lenders.

Most readily useful Exposure Feedback

Even if a couple some body age dismal money and you can credit score, they may twist other degrees of exposure to help you a mortgage lender. To your enhanced usage of technology and more usage of borrowers‘ research than ever before, lenders will be able to conduct finest risk studies.

Ergo, there may be higher requirements to have lowest-money and you can poor credit lenders. Furthermore, lenders can charge the correct pricing while they has better risk testing methods, eg, using AI getting exposure investigation. Might be aware of the most practical way to get currency when credit so you’re able to reduced-money, bad-borrowing from the bank anyone.

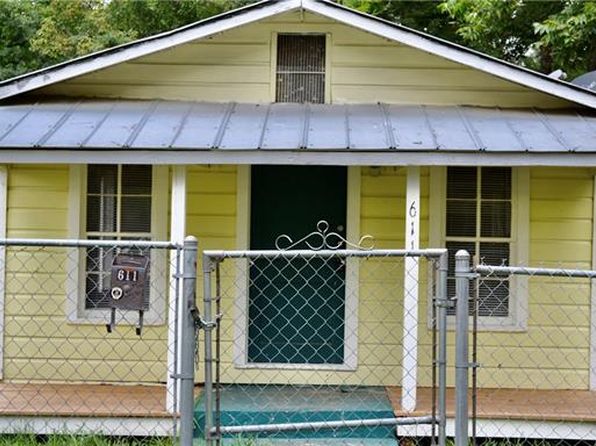

More affordable Housing

Because the low-earnings and less than perfect credit individuals boost, competition among people to add economical property increases. There is going to hence become more reasonable homes units designed to give more folks toward chance of home ownership.

We provide inexpensive casing options to develop, such as for instance, cellular and you will prefabricated house. The reduced-costs household causes it to be easier for borrowers to locate loans and you will lenders to get costs.

You will see of many alterations in the future in regards to domestic loans to possess less than perfect credit and you can reasonable-earnings anybody. Best exposure studies, more affordable housing, even more mortgage selection, homebuyer planning, and alterations in the definition of low-income & poor credit will be different subsequently. The degree of the changes are different depending on the alter from the monetary activities impacting owning a home.