step one. Clear and you can obvious important. Disclosures are unmistakeable and obvious for purposes of 1041.9 if they are readily understandable in addition to their area and kind proportions are conveniently visible to customers.

1. Digital delivery. Section 1041.9(a)(2) lets the fresh disclosures required by 1041.9 becoming offered as a consequence of digital delivery as long as the latest standards off 1041.9(a)(4) is actually satisfied, as opposed to regard to the newest Electronic Signatures from inside the Globally and you may National Business Act (E-Signal Work) (fifteen U.S.C. 7001 mais aussi seq. ).

Whenever a loan provider loses a customer’s accept receive disclosures through text, such, but have not shed brand new buyer’s say yes to discover disclosures through current email address, the lending company may consistently offer disclosures through email, provided most of the standards for the 1041

step 1. Standard. Digital disclosures, into the the amount allowed by the 1041.9(a)(4), are retainable having reason for 1041.9 when they in a design that’s able to being printed, spared, or emailed from the user. For example, the requirement will not apply to a digital short observe that is offered on buyer’s cellular phone as a text. In contrast, should your availableness is provided with the user through current email address, the newest observe need to be within the an excellent retainable mode, it doesn’t matter if the user uses a cellular phone to access the fresh new find.

1. General. Section 1041.9(a)(4) it permits disclosures required by 1041.nine to be provided thanks to electronic delivery in the event your individual concur conditions less than 1041.9(a)(4) try fulfilled.

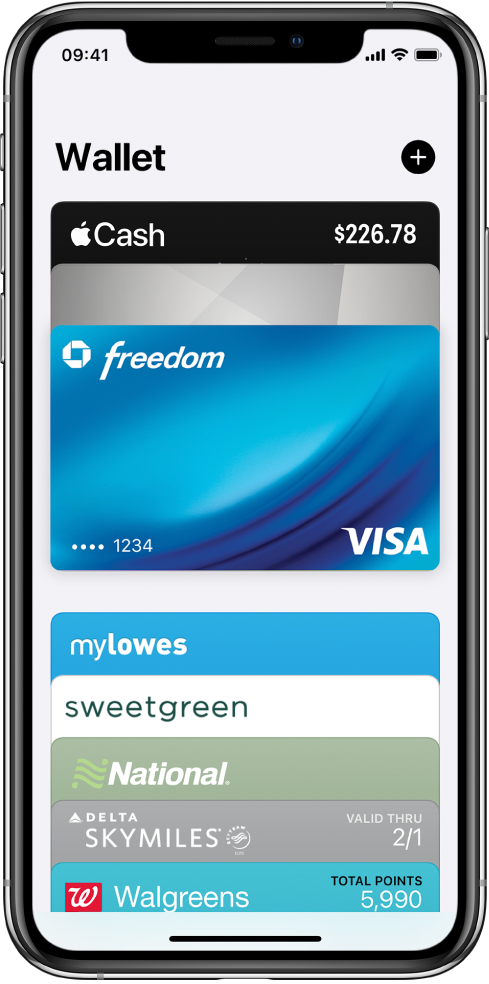

step one. Standard. Point 1041.9(a)(4)(i) it permits disclosures required by 1041.nine to get provided due to electronic delivery when your bank obtains the new buyer’s affirmative accept have the disclosures owing to a specific electronic delivery approach. Which affirmative consent demands lenders to provide consumers having a choice to select a certain electronic beginning strategy. The new concur need certainly to clearly show the process out of electronic beginning one could be made use of, for example current email address, text message, or mobile application. Concur provided with examining a package in the origination techniques could possibly get meet the requirements as being written down. Agree can be obtained getting several ways of digital beginning, nevertheless the consumer must have affirmatively picked and you may considering agree getting each means.

1. General. Area 1041.9(a)(4)(i)(B) will bring that when getting user accept digital beginning significantly less than 1041.9(a)(4), a loan provider must provide an individual with an option to found the fresh disclosures due to email. 9(a)(4).

The overall needs to provide disclosures in https://paydayloanalabama.com/hollins/ the good retainable mode does perhaps not apply if electronic small observes are given for the through cellular application otherwise text

step one. General. The brand new ban with the digital birth away from disclosures for the 1041.9(a)(4)(ii) pertains to the specific electronic opportinity for and that consent are lost. 9(a)(4) is actually came across.

dos. Death of concur applies to all notices. The loss of concur relates to every observes required by 1041.nine. Instance, if the a customer revokes agree in response on the digital short notice text put in addition to the payment find less than 1041.9(b)(4)(ii), you to revocation and relates to text message beginning of digital small notice that will be produced towards the consumer legal rights see below 1041.9(c)(4)(ii).

step one. Revocation. For purposes of 1041.9(a)(4)(ii)(A), a consumer could possibly get revoke concur for any reason and also by people sensible means of communications. Realistic technique of communications are priced between calling the lender and revoking consent orally, mailing an effective revocation in order to an address available with the lending company towards the their consumer telecommunications, delivering a message response or hitting a beneficial revocation hook up provided within the a message on the financial, and reacting of the text in order to a text delivered of the the lending company.