For many of us, to purchase a home is the most life’s essential milestones; everyone imagine are homeowners. But with the previously-escalating cost away from home, it is as an alternative tough to very own a property as a consequence of our very own offers. But there’s you should not lose in your desires. You could nonetheless pick one flat, cottage or apartment, or buy a piece of house and build your perfect house with it by just using up the best sorts of family financing. Yes, there are several different kinds of mortgage brokers as you are able to pick from. We have found an in depth glance at all of them.

- Typical household loansA typical financial is considered the most prominent types of of loan, taken to buy a flat, bungalow, property or any other assets that’s sometimes freshly developed otherwise not as much as construction. You can even get an effective pre-current assets if you take on a normal financial. This really is one of the most well-known sort of lenders, specifically if you need to pick a home. The interest rate about types of financing may be repaired or drifting and that’s calculated till the financing is actually disbursed.

- Home construction loansIf you don’t want to buy a property that is pre-constructed and prefer to customise it to your own specifications, you can take out a home construction loan. To be eligible for this loan, you need to own a plot of land, which you can also get by taking on a additional particular house loan a land purchase loan. If you want to include the plot cost in the home construction loan, you need to ensure that the land is purchased within a year. The loan amount you can get is determined on the basis of the cost of the plot, and you also need to provide a rough estimate of the overall house construction cost. Such loans are typically disbursed in a single lump sum or in instalments as construction proceeds.

- Property buy loansAs in the above list, a land purchase mortgage is also one of several differing kinds from house loans. This sort of loan exists by the really home loan loan providers and provides you the flexible option of to shop for a story regarding land on which you could grow your family. You can purchase the latest land having that loan whenever possessions pricing try low, and you may build can be carried out when you have the finance. You are able to buy the homes exclusively to own investment purposes and you will sell to possess a revenue.

- Household extension or extension loansIf you want to make any changes to the house’s establish framework, you might make an application for unique version of homes money also known as family expansion or expansion money. Such as financing enables you to construct this new rooms, include or get rid of their proportions otherwise include floors on your existing property, offered you have the data to mandate the fresh structure. You can transfer one or two flats you possess towards one highest apartment, or make a duplex while making almost every other adjustments using this type of out-of loan.

- Do it yourself or repair loansEvery long-time, you might find the requirement to re-painting your residence. You may have to enhance a leaky ceiling otherwise hide those people clinging wiring that produce our house browse ugly. The expense of those fixes are more than anticipated and you will a home upgrade otherwise restoration loan is the appropriate house loan to help you satisfy these types of costs. Do it yourself funds are going to be brought to refurbish the latest interior spaces, along with restoring the fresh new ceramic tiles, updating this new electrical program if you don’t modernising your property how you adore.

- Household conversion loansIf you take home financing, however, should sell the house and purchase a special one to in put, you could potentially grab another kind of household financing labeled as a home conversion financing. Like that, you can purchase a unique family in place of interested in a separate bank — you can just transfer your current financing to your new house. The amount of money with the brand new home will be establish because of the selling the existing home, and that means you don’t have to worry about paying off the previous financial. Last word: What type of home loan you opt for hinges on your circumstances, but what you must contemplate is you can rating restrict finance as high as 85% of actual market value of the property. Because of this you will want to deliver the leftover 15% as downpayment. Home financing makes it possible to understand your ideal to be a citizen. Also, since these are a lot of time-tenure fund, you could conveniently pay back her or him when you look at the simple and easy affordable monthly EMIs.

MCLR home based Mortgage

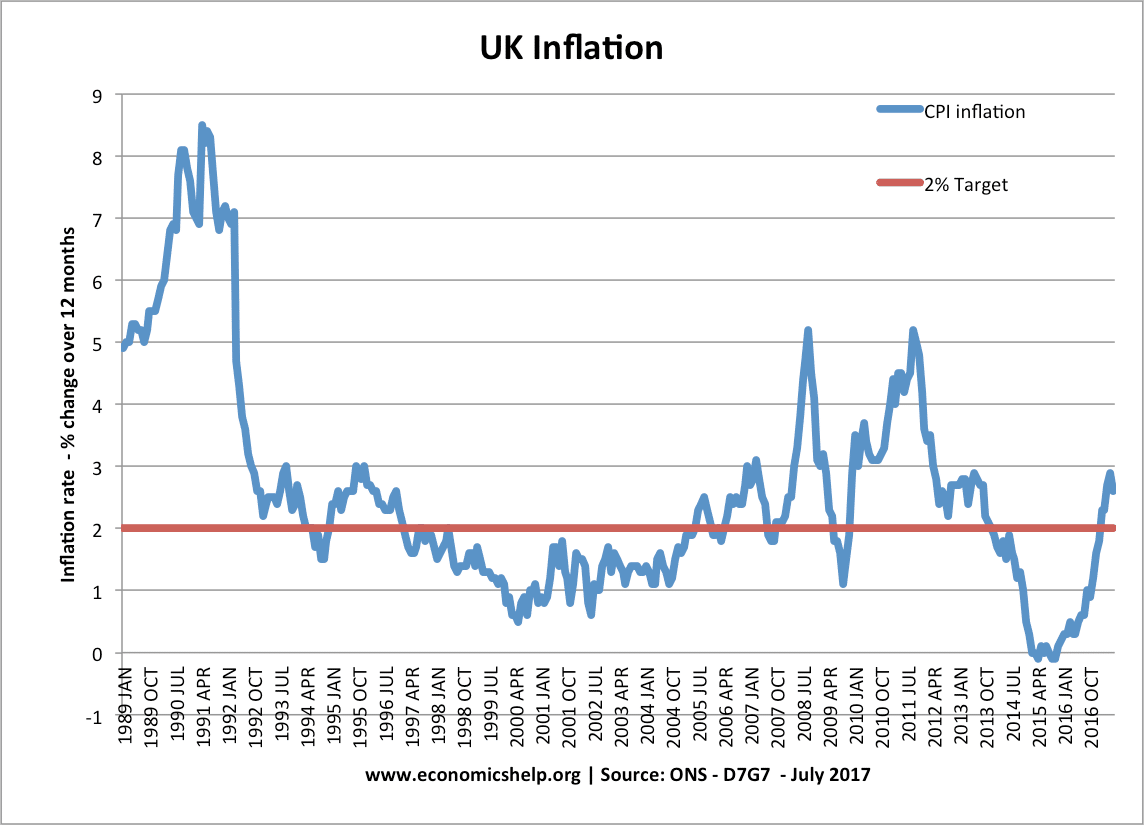

The rate the most important components of a loan, particularly in the truth out-of a premier-really worth financing one lasts for 20 years or maybe more; our home financing.

Brand of Financial Fees

Many installment loans Memphis people complete the desire to of becoming home owners by taking away a mortgage. It is the easiest way to cover the a home in general can pay for the house from inside the monthly instalments.