Experts alert the fresh Coalition’s first-financial put system you can expect to drive upwards assets rates that’s no solution to taxation transform you to beat investors‘ masters

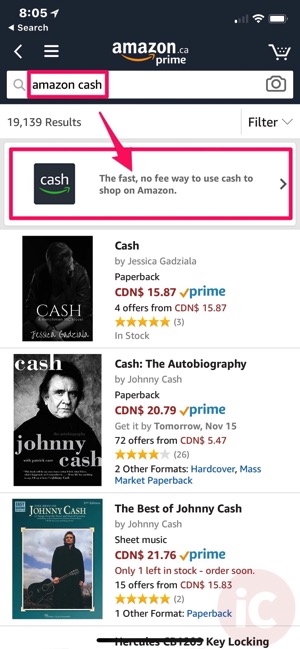

The new Coalition possess assured to help 10,000 earliest homebuyers into the field from the topping right up its 5% dumps having a national ensure to own 15% of your mortgage.

Scott Morrison claims the policy is not free money however, advantages have already informed it may be useless at the lifting owning a home rates or counterproductive by bidding upwards costs.

Work has recently invested in fits they thus we’d ideal score over the rules that’s brought in a few mode anybody who gains the fresh election.

Which gets it?

American singles getting doing $125,000 otherwise people generating as much as $two hundred,000 might be qualified to receive the initial-home loan put design whether they have saved 5% of your own property value your house.

The us government commonly reserved $500m out of equity from National Houses Funds and Financing Agency to ensure fund up to a worth of 20% of the home. Consumers don’t need to enjoys the full 20% deposit and can rescue to $ten,000 by the without to pay lenders financial insurance coverage.

This new scheme is restricted to 10,000 earliest homebuyers, approximately you to-in-10 of the 110,000 Australians whom purchased its basic family into the 2018.

The government possess recommended there’ll be regional caps towards worth of homes whereby it will guarantee a deposit.

How much time really does the new verify past?

Due to the fact earliest homebuyer possess lent 95% of the value of our house, government entities verify persists until the homeowner refinances.

Will it be risky into regulators?

Scott Morrison informed the latest Liberal class launch towards Weekend the policy is not free currency and you may lenders have a tendency to nevertheless do-all the normal monitors into borrowers in order to ensure that they’re able to meet its repayments.

Grattan Institute houses professional Brendan Coates informed Guardian Australian continent about skills from a standard the lending company would have to score its money before the regulators if you don’t they cannot treat it since the a national-protected deposit.

Morrison expected which objection by the arguing that citizens re-finance if equity develops that it perform around a beneficial Liberal Federal government that is courageous while the domestic costs are currently dropping consequently they are expected to slip further into the Quarterly report and you will Melbourne.

Scott Morrison told new Liberal class promotion launch in the Melbourne with the Week-end your Coalition’s suggested earliest homebuyers‘ strategy isnt 100 % free money‘. Photograph: Mick Tsikas/AP

Can it functions?

Whether your scale is far more very first homebuyers going into the business, Coates told you the insurance policy is often will be useless or counterproductive.

Since it is simply for ten,000 homeowners it’s not going to apply at home ownership prices but alternatively bring forward this new sales away from an effective very brief group of people who’ll manage property anyway however they are just shy of the 20% deposit, he said. The true hurdle so you can entering the marketplace is that lenders has actually to be pretty sure people you are going to afford home financing which have 7% rates of interest.

Whether your verify do trigger individuals who wouldn’t if not find a way to pay for a property hit the market, following it will impression rates, Coates told you. It actually starts to look more instance a first homebuyers give, they estimates up prices in addition to providers earn.

Morrison told you the policy have a tendency to build a big difference, cutting the time brought to rescue to have in initial deposit by at minimum half of and.

In case the aim is to try to slice the time for you built a deposit, it could be a survival. RateCity, mortgage testing web site, has determined the brand new strategy you may reduce enough time taken to save yourself to possess in initial deposit because of the more than five years for people life in Questionnaire, several years when you look at the Melbourne and you will 36 months for the Brisbane.

However, RateCity browse manager Sally Tindall told you a thirty-year financial having an effective wafer-slim put is a recipe to blow many even more within the attention for the financial along the life of the mortgage.

Considering RateCity’s calculations, to acquire good $five hundred,000 possessions which have a 5% put as opposed to 20% costs an extra $58,774 across the longevity of a thirty-year financing.

Apra [Australian Prudential Controls Power] keeps spent the final couple of years informing financial institutions to be mindful away from credit to Australians that have lower deposits, Tindall told you. Today the major governmental functions are earnestly guaranteeing it.

Which are the government?

Through to the 2016 election Work suggested taxation transform so you can suggestion the new equilibrium of the housing industry regarding dealers and you can for the first homeowners.

The Coalition ruled-out pursuing the Labor’s offer to help you phase away bad gearing online payday loan Arizona having present features and to halve the main city development tax dismiss. It argued one to Labor’s rules may cause rents to go up and you may domestic pricing to-fall, regardless of the treasury advising the purchase price perception was apparently modest.

If you are face-to-face Labor’s bundle gave brand new Coalition an effective attack range, it left a space within the individual offering it needed something you should state in the houses affordability.

Since that time the brand new Coalition has been in research out of guidelines so you’re able to assist first homeowners rather than striking home cost, such as for instance allowing so much more very first homebuyers to utilize the tax experts from superannuation to save to have in initial deposit. Just 2,800 somebody yet purchased that system now the fresh new Coalition is attempting to locate a different way to help people who have adequate income to afford repayments yet not adequate discounts discover a leg on assets hierarchy.

Coates said the initial-mortgage put design suggests brand new Coalition’s genuine challenge would be the fact they desires to let basic homebuyers without harming some one. The fact is very first homebuyers can just only victory if someone manages to lose.

Coates said Labor’s bad gearing coverage would not hurt rates however it will assist very first homeowners once the a whole lot more dealers commonly sit on brand new sideline.

The newest Coalition is still seeking code it’s quietly off very first homeowners instead of looking for home prices to-fall.

This new decision

The original-financial deposit strategy is likely to be appealing to anyone towards the cusp of purchasing their very first family.