- Just how much credit make use of: Simply how much credit you use is the amount you’ve borrowed versus just how much you might borrow. Such as, you have a cards utilization proportion away from ten% when you have a good $step one,000 equilibrium with the credit cards which have an excellent $ten,000 limit.

- Latest credit apps: Previous borrowing apps means how many accounts you removed in past times two years. Any latest home loan pre-approvals otherwise credit card applications will appear here.

Each factor enjoys a different sort of effect on your get. Such as for instance, percentage history usually has the quintessential considerable impression, when you are credit programs and type of membership have less off an enthusiastic perception.

Does Providing Pre-Accepted Hurt Your Borrowing from the bank?

In a nutshell, sure, delivering pre-acknowledged having a home loan make a difference your credit rating. Although perception are below you expect and must not stand-in how people taking finally recognition to possess a home loan.

When a loan provider inspections your own credit to possess a home loan pre-acceptance, they work with an arduous query. A challenging inquiry can result in your own rating so you can drop quite. The newest impact on the borrowing from the bank could well be limited. The small credit history alter just after pre-approval wouldn’t result in the lender to alter its head whether it comes time and energy to submit an application for a home loan.

The miss is actually brief. If you always spend your bills timely and generally are fast with your mortgage payments after you receive one, your credit score will soon get well.

Just what are Different types of Borrowing Concerns?

There’s two means of checking borrowing. A lender you will manage a smooth otherwise difficult inquiry, with regards to the situation. Every type out-of borrowing from the bank query features a new influence on your credit rating.

Difficult Borrowing Concerns

Whenever loan providers perform the pre-approval process, they work at a painful borrowing from the bank inquiry. A difficult credit inquiry feels like a giant banner one says to other loan providers you’re in the process of making an application for financing.

A hard credit inquiry impacts your credit rating, because it signals that you’ve has https://paydayloanalabama.com/gulfcrest/ just applied for borrowing. When you have multiple brand new credit programs on the credit history inside a short span, such as for example within this a few months, a lender you will notice that due to the fact a warning sign otherwise a good indication that you will be with financial difficulties. Always, more difficult inquiries you’ve got during the a restricted months, the greater significant the impact on the rating.

For that reason, this is best if you don’t make an application for an automobile mortgage, credit card and other type of financing while you’re making an application for home financing.

It is vital to just remember that , even when an arduous inquiry tend to explanations a rating to decrease, hard questions inside and of by themselves commonly necessarily crappy some thing. You would like a painful inquiry to track down any kind of mortgage.

Smooth Credit Issues

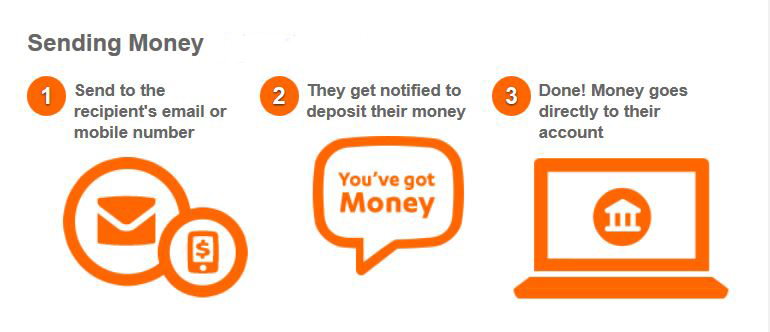

A mellow borrowing from the bank query does not have any an impact on the borrowing from the bank score. A smooth inquiry takes place when you look at your credit file. A loan provider will not to able observe that you’ve manage a good credit score assessment for the on your own.

When the a loan provider would like to pre-accept your to have a charge card, they and work with a softer inquiry on the credit. The lender uses all the info it reach assembled a beneficial credit card pre-acceptance bring to send you. Almost every other examples of a softer inquiry were whenever a computer program company checks your borrowing from the bank in advance of starting an alternative account otherwise when an enthusiastic employer works a card assessment in advance of employing you.

Really does Taking Several Pre-Approvals Hurt Your credit score?

Doing your research getting home financing is sometimes needed to the people looking to invest in a home. But, in the event the taking pre-recognized getting home financing means an arduous query on the borrowing statement, would not taking several pre-approvals do several hard questions, increasing the problems for your credit rating?