In addition to for the legal side, we had several challenges/costs: (a) during the about certain states, you only pay a huge taxation to help you list the borrowed funds (ours is actually thousands of dollars); (b) i used a name company along with to expend all of them a great few thousand dollars, too; and you can (c) even after solicitors going flat-out, it took a month or more to-do everything. (not to mention (d) the mortgage appeal you have made might be subordinate toward prominent mortgage(s), and therefore you are next in-line (at the best) in the event your relative doesn’t shell out you, and (e) new property foreclosure process is high priced and much time if you are planning to help you impose your legal rights.)

The basic build is that after you borrow money shielded by the your home the lender keeps a claim on your own domestic

Towards interpersonal front, should your cherished one stops to invest your back, would you very foreclose in it? Or loans Mamanasco Lake is the concept one to recording the loan attention create merely make sure any left money would go to you individually as an alternative of friend? Whether your second, have you been certain that you will find adequate equity to afford existing mortgage(s) and your own personal?

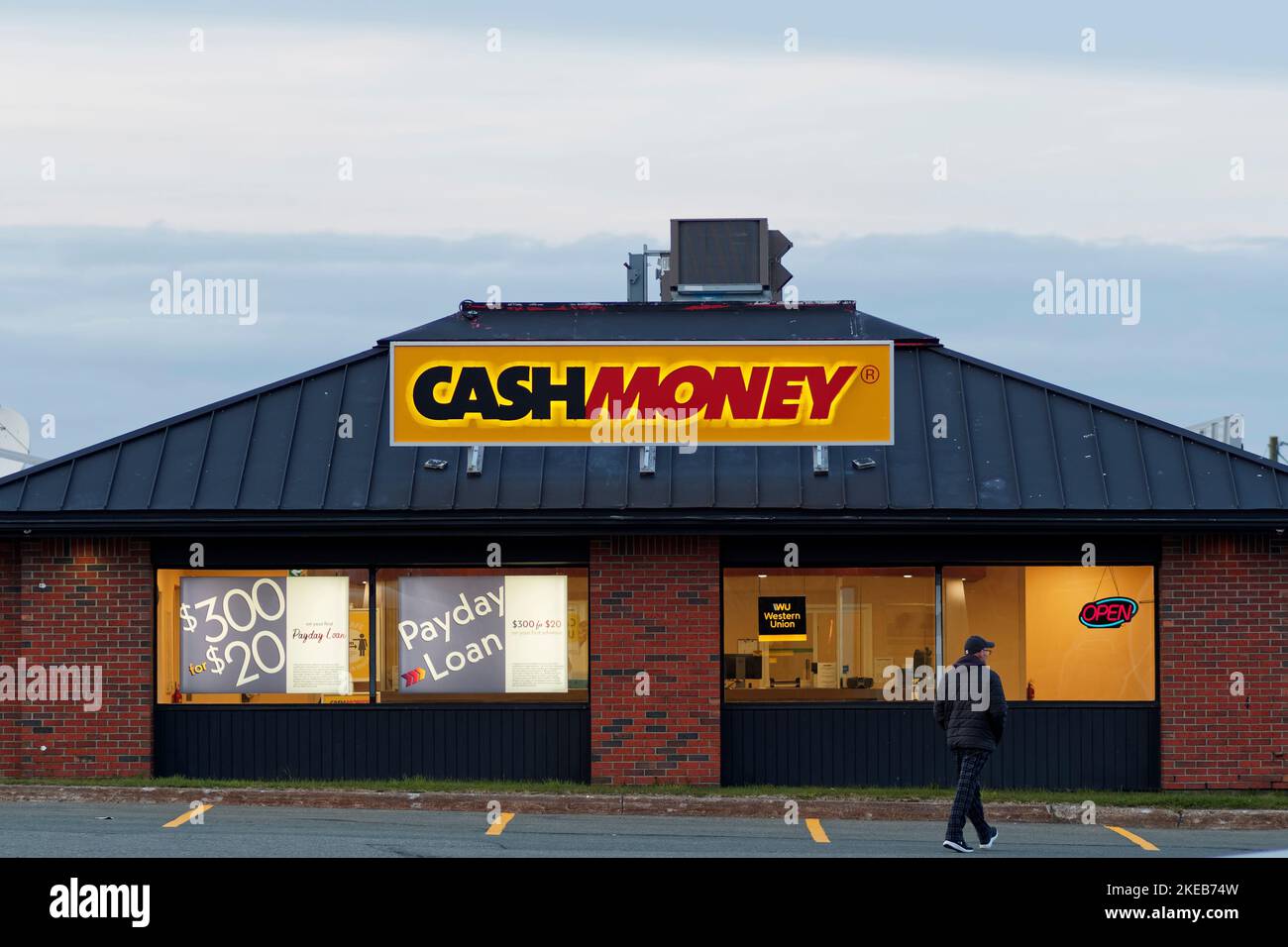

There will probably currently end up being a financial B, there also currently may be most other liens (claims) up against the possessions, (right back fees, so-called mechanics liens, „difficult money“ lenders instance

Nothing in the would be to say that it can’t performed, but that have only undergone an equivalent process the loan region are really more complicated than just a couple of hours away from lawyer date. printed from the AgentRocket from the 8:18 In the morning for the [3 preferred]

This will depend where you are. You would like somebody to draw in the documents, buy them closed and listing them, query a concept/escrow team. Needless to say this may rating fraught although auto mechanics aren’t you to definitely complex nevertheless could cost virtually based upon the latest county. In Oregon that you do not required legal counsel, inside the Ny your literally performed. As an instance should your cousin ordered their residence that have a loan regarding a bank A beneficial then got a house collateral loan of bank B Bank A have actually allege into the all the domestic, Financial B should wait until Lender A need obtained all of its money, (and additionally property foreclosure expenditures etcetera.,) just before it get one thing. For many who give currency with the cousin on the family due to the fact equity an informed status you’re within the ‚s the status out-of Lender B. ) The latest liquidation of the property won’t become getting the purchase price it could get on Zillow etcetera. you could think getting an incredibly unjust rate. You don’t get one say about count. If nobody estimates enough to match the debt owed Financial A, Financial A could „buy“ it and cancel the debt as well as most other lenders was aside regarding chance.

Depending on this new amounts of money/age relatives etc. only credit them the money and you can filing a beneficial lien will most likely not be the best services, the latest lien will not fundamentally promote that much security and is likely to rates currency to make and demand, for those who fees them notice you’ll have to shell out income tax on it. You might be money ahead for many who pay only its mortgage having a year.

It sounds like you should have monetary suggestions that’s more and more all of them than just yourself. Was these family members older? Is this in the housing or preservation out-of assets for future years? Is it a crude plot or yet another updates quo? released by Pembquist on PM into the

Toward courtroom front, we’d three principal data files: (a) a contract you to definitely spelled away our offer, (b) a good promissory observe that created the mortgage (making use of the necessary interest because the snuffleupagus showcased), and (c) home financing interest in our house you to definitely supported the loan count. There were a number of supplementary documents the „seller“ was required to signal at the closure, too.