** Brand new monthly payments found here dont were additional charges like while the home insurance, property taxation, otherwise PMI for the antique money. Costs is like objectives just. Not based on on the market prices.

A massive advance payment together with guarantees less rate of interest. That’s because once you pay a lot more initial, the borrowed funds financier considers you a low-risk debtor.

Luckily, the latest down-payment does not only come from your own coupons. Advance payment provide notes today make it easier to get your dream house at the down rates. Home loan financiers can allow bucks gifts out of relatives and buddies users to aid lessen the payment per month.

But not, just before playing with current bucks, be sure to file your own provide securely to stop rejection of the the lending company. You will want to generate a proper gift letter saying the quantity, this new donor’s pointers, and you may a page certifying that present is not a loan inside disguise.

Particular mortgage applications that allow current fund for a downpayment is traditional fund, USDA money, Virtual assistant funds, FHA money, and jumbo fund.

Loans to help you Income Ratio

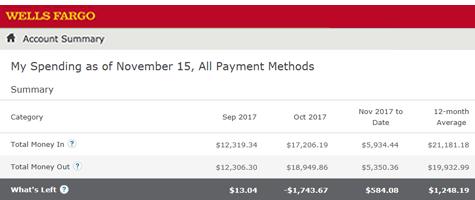

As stated, lenders study your debt-to-earnings proportion whenever obtaining financing. Based on their DTI, they could determine how the majority of your monthly income would go to debts and just how far you can place toward the loan repayment.

Add up your minimum monthly payments for your charge card costs, car loans, student loans, personal loans, and any other debts (Cannot are your own energy costs, grocery costs, or lease.)

- Which is your DTI.

Such as, someone who produces $5,000 30 days and you can pays $dos,000 1 month with the expense possess a great DTI off forty%.

DTI find your own qualifications for a loan system. A traditional mortgage requires a DTI perhaps not surpassing 45%, while FHA finance require a great DTI off fifty% or even more. not, in most cases, a DTI exceeding 43% minimises your chances of bringing a mortgage.

Fees Several months

Their mortgage loan’s repayment period is the very long time the financier set for you to clear this new loanmon repayment periods are 29, 25, 20, 15, and you will ten years.

*** New monthly obligations shown here do not become even more fees eg since the home insurance, possessions taxes, otherwise PMI towards conventional finance. Costs is instance having intentions merely. Perhaps not based on currently available prices.

On the malfunction, a lengthier financing cost reduces the new payment per month, therefore letting you match a more costly household into your month-to-month funds.

However, moving from debt more than three decades setting you’ll pay alot more attention. Also, a shorter fees months comes with straight down interest levels. For this reason, you could rescue more on the eye prices.

You may want to choose to begin by a lengthier fees period and you may change to a shorter-title as your earnings grows. You can pay just the brand new closing costs in your the new terminology in order to ensure the the newest payment was reasonable.

Interest rate

How much cash you have to pay yearly is shown as the a portion of one’s dominant count. Instance, a beneficial $100,000 loan draws an interest from $cuatro,000 a year at a level regarding 4%.

Your mortgage’s interest rate may affect how much household you could potentially pay for. Even when the household have a high price, a reduced rate of interest tend to notice a lowered payment per month. On the other hand, the reduced the interest rate, the greater amount of reasonable the borrowed funds.

Once again, we look at the $three hundred,000 house or apartment with a good 5% downpayment installment loan Kingston NM and you will a thirty-seasons mortgage title. We would like to consider the outcome of great interest prices into cost of your house. Per row represents a good 50% boost in the speed: