Getting married has several economic consequences; it will boost otherwise reduce your taxation. It will change the variety of retirement levels you will be qualified to receive. It does apply to their insurance rates. And you can yes, having a wedding may impact a home loan.

If you find yourself there are many different what things to to take into consideration when you get property, you will possibly not have regarded as in the event both parties are going to be for the mortgage while you are partnered. In many cases, which have only one people into financial may be the most useful solution.

When you’re partnered and you are using diving on actual estate market, this is what you need to know on purchasing a property in just you to companion on the loan.

Unfortunately, home loan enterprises would not simply make use of the higher credit rating involving the both of you, or the average of your score; they will certainly pay the very attention to a decreased credit score. Therefore if your spouse features a credit history who stop you from acquiring the best possible rates, you might think making your wife from the mortgage if you do not you need the spouse’s income to help you qualify for a ount.

You to definitely Wife or husband’s Income Doesn’t Qualify

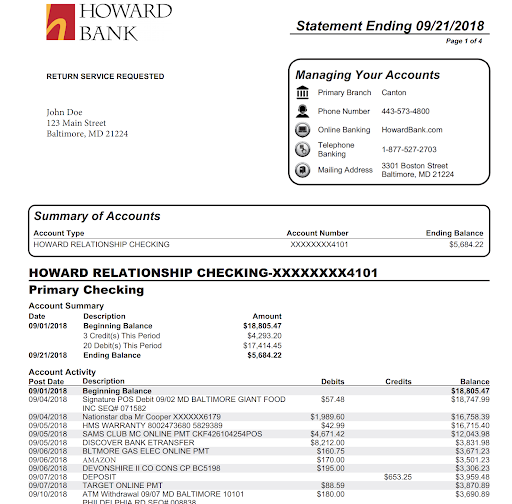

What’s known as 2/2/2 was a standard code for everyone files criteria. This simply means which you yourself can you need a couple of years of W2s, a couple of years off tax statements, as well as 2 weeks regarding financial comments. Dependent on your role, a whole lot more files may be required. Alternatively, quicker papers may be required according to brand of financing you are getting, nevertheless shall be prepared with this documents and if.

Today if one mate will not meet these types of requirements, state it lover doesn’t have couple of years away from W2s, it might make experience to depart that it spouse off the financial. If the spouse try worry about-operating, he/she will you prefer 2 yrs regarding team yields as an alternative. If for example the spouse is unable to give so it documentation, as an example if they only has been in company for per year, then it can make experience to depart which partner off the loan.

What you should Discover Leaving Your spouse From the Mortgage

If you find yourself the only one for the mortgage, new underwriter simply think about your borrowing from the bank and you can financial situation, proper? It is really not always that facile. Here are a few what to know if you’re partnered and getting a home loan instead your spouse.

You’ll likely Be eligible for an inferior payday loan Needham Amount borrowed

When you are element of a-two-earnings domestic, taking home financing in both spouses‘ name usually means that you’ll be able to meet the requirements for a larger mortgage. But not, in case your partner actually to your loan to you, your own financial won’t consider carefully your wife or husband’s income. Ergo, you will most certainly have to settle for an inferior, economical house.

The latest different to this could well be money you to account fully for money away from family relations whether or not these include towards the mortgage. An example of this would be outlying creativity fund regarding the USDA where your income has to fall lower than a specific peak. Merely particular loan providers use USDA loans.

Shared Bank account Are just Okay

So-let’s say you might be using only you to income in order to qualify, you enjoys a shared family savings along with your companion? It doesn’t really feeling underwriting. While you’re listed on the account and it is a shared account, couple are lawfully permitted to accessibility most of the financing. When you’re into the account, it’s your money plus it would not twist any damage to your financial.

Your Mortgage company Looks at the Wife or husband’s Debt

In the event your mortgage company approves your for a financial loan, they look at your debt-to-income (DTI) proportion, which is the part of the gross income one to goes to debt. Their DTI may have a huge affect your house financing. If an individual partner has a lot of debt, you can consider staying your ex partner off of the mortgage to help you decrease your DTI proportion. not, in the event your house is inside a residential district property county and you’re getting good FHA otherwise Virtual assistant mortgage, all of your financial situation could well be taken into consideration.

What exactly is a community possessions condition? In the a residential district possessions county, most of the property as well as loans fall under each other spouses. The phrase, What exactly is your are mine and you can what’s mine try yours is actually actual legislation on these claims: Arizona, California, Idaho, Louisiana, Las vegas, This new Mexico, Tx, Washington, and Wisconsin. If you reside in just one of this type of claims and you’re bringing a beneficial FHA otherwise Va financing, your own mortgage company can look at the costs from each other spouses.

Will you be plus partner provided a-one-spouse home loan? Speak with a mortgage expert observe what is going to performs most effective for you plus condition. If you are worried broaching this plan might offend your spouse, make sure you declare that it doesn’t mirror people distrust by you. Highlight as to the reasons it generates economic experience, and most partners tend to know what your location is from.